Celebrating Armen Alchian and Maverick Evolutionary Economics

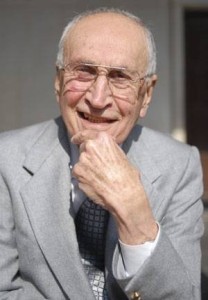

Imagine finding yourself on the campus of UCLA in the late 1940s. If you were to have ventured anywhere near the economics department, you might have bumped into one of UCLA’s newest hires, who would become among the most insightful and original economists of the twentieth century, a vigorous man with the interesting name of Armen Albert Alchian (born April 12, 1914). Alchian was a maverick economist who always held the respect of the mainstream. You would most likely be charmed by his conversation. As an expert on the language of economics once said, “Talking about economics with Armen Alchian is like talking about painting with Pablo Picasso.”

Throughout the 1940s, while Christian Dior’s New Look was revolutionizing women’s dress, the big trend in economics was to adorn itself in ever more complex mathematical garb. Gradually and incrementally, economists began thinking more in terms of mechanical rather than natural reasoning. Economists began paying more attention to the elegant properties of their economic models, less to the messy details of the economy itself. Economic choice was about individuals pursuing given ends with scarce resources. Economic competition was a general equilibrium solution of each firm having maximized profit and each consumer having maximized utility across income and leisure. If you couldn’t pass at least Calculus II, you would soon be lost amid the leading economics publications of the day. The coronation of the mathematical modeling approach to economics occurred with the ceremonious publication of Paul Samuelson’s Foundations of Economic Analysis in 1948.

Over at UCLA, Armen Alchian had little patience with it all. In a 1996 essay called “Principles of Professional Advancement,” Alchian looks back at his own reaction.

In my early years of teaching, a pair of confrontational articles by a Professor Richard Lester and a Professor Fritz Machlup, published in the leading journal, The American Economic Review, were dutifully studied with disappointment and distress. Current readers will be astonished to know that the debate was about whether business people “really” used marginal productivity and profit-maximization analysis in making decisions! Lester said “no”; Machlup said “yes.” Of course, both were right and both were wrong, but their reasoning and defenses were easily demolished by each other

If that was the quality of analysis passing for economics, I should have stayed in the military I thought. So, one day in class I explained what I had read. Then a bit testily, I complained about the quality of the articles, all in the privacy of the classroom. I then explained what I thought the two economists should have said. They should have said, “Read Darwin! It’s not what you think you are doing or how you rationalize your choice of that action. It’s whether the action has survival value. And if outside analysts can identify the reasons the chosen action had survival value, and in what direction changes in the environment (constraints) affect survival conditions, economists don’t have to worry about how people discover by thought or luck what are the new best conditions. Competitive trial and error will evolve toward the fittest—whom economists characterize as profit maximizers.

Alchian would soon entrust his classroom rant to the care of his scholarly pen. In 1950, he published a landmark paper in the Journal of Political Economy. In a mere ten pages, Alchian’s paper posed a stunning critique of mainstream economics while offering a viable yet simple alternative. And the only math is in the page numbers. Alchian says market competition should be studied like a natural environment that selects some firms over others. As in nature, the key to market competition is survival. And as market conditions change, successful firms will be the ones that adapt in order to stay profitable. There is no maximum level of profits. There is no elegant mathematical solution toward which firms must aspire. There is only adaptation to continually changing conditions, or there is death. This insight changes the entire way we look at economic life. The marketplace is an adoptive system, and success is ever-evolving.

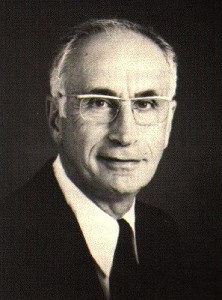

Alchian merges with F. A. Hayek’s famous critique of Samuelsonian mathematical modeling: the economic problem is to grapple with scarce resources in an evolving world of competing ends with only imperfect, limited and dispersed knowledge. Alchian and Hayek are later joined by James M. Buchanan, whose similar critique of maximizing & equilibrating economic thinking leads him to a similar evolutionary alternative. Channeling Mises, Buchanan argues that economists should model competition as a catallactic or symbiotic process through which people who might otherwise be in conflict instead come to trade or otherwise cooperate with each other to their mutual gain. “This mutuality of advantage that may be secured by different organisms as a result of cooperative arrangements, be these simple or complex, is the one important truth in our discipline,” Buchanan said (I elaborate here). These are fruitful yet relatively neglected alternatives to the mainstream approach.

Is the economy mechanical or an ecosystem? Has the temptation to justify policy interventions on the basis of mathematically elegant yet economically artificial models brought more harm than good? Has doing so created the dynamic of interventionism that Mises analyzed, which now requires policymakers to “do something” even when no one believes the particular something being “done” will work?

The mainstream of economics has been in a Ptolemaic rut for nearly a century, and has spun its tires ever faster since the Great Recession. The Copernican (re)turn will happen when mavericks like Alchian, Hayek, Buchanan, and Mises are at the helm. Step right up, gentlemen, the evolving economy is waiting.

One thought on “Celebrating Armen Alchian and Maverick Evolutionary Economics”

Comments are closed.